THIS is the time of the 12 months for reflection and new resolutions. Many I do know would do up an inventory and ask themselves whether or not they have completed what they set out for the previous 12 months.

It is similar for me. So as information experiences have been coming in on forecast of the inventory marketplace for 2022, I took the freedom to assessment the analysis homes forecast in the beginning of 2021 to evaluate what number of of them had been on level or a minimum of near the year-end closing prediction in the beginning of the 12 months.

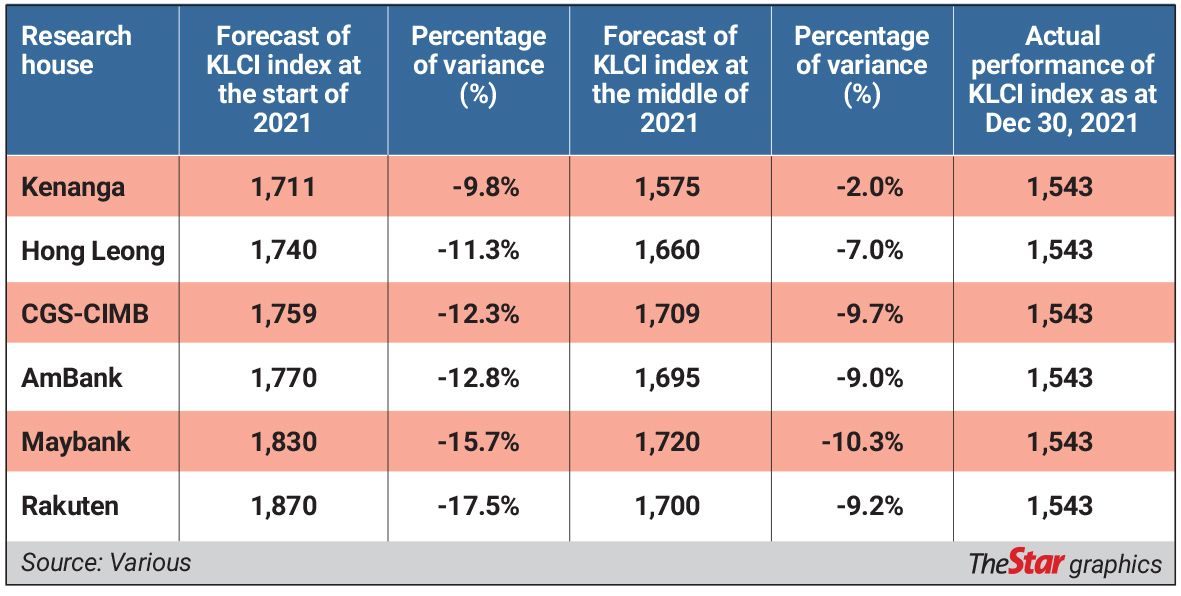

One can confer with the desk connected.

From the desk, it’s fairly clear that majority are off the mark from the preliminary anticipation in the beginning of the 12 months.

The variance is as vast as 9.8% to 17.5%. In the center of the 12 months, most analysis homes then revised their forecast based mostly on the occasions that has occurred.

Even then, just one analysis home was inside putting distance of the particular final result with a variance of two%. Others had been far off the mark.

The query then is why will we get caught up within the hype of forecast and prediction in the beginning of yearly, when it’s a transferring goalpost as a result of variables that occur all year long?

Unless one has the flexibility to see the longer term, in any other case it could look like this act of forecasting is an train of futility.

In my humble view, the innate want of people the place we want some kind of indication or overarching steerage for the unknown highway forward contributes to such hype within the first place.

It is extra of an emotional want that drives it. Some would argue superstition.

This isn’t not like “Paul the Octopus” who made prediction of soccer matches throughout the 2010 World Cup. Whether there’s an precise empirically backed knowledge or formulation which may result in an objectively correct final result in index forecasting is a giant query mark.

Ultimately, though expectations for a speedy restoration in 2021 was each excessive and untimely, as a result of subsequent flip of occasions together with declaration of emergency, one other change in authorities, the surge of Delta variant and repeated lockdowns adopted by insurance policies in Budget 2022 that isn’t beneficial in direction of the inventory market, the FBM KLCI index has been a regional underperformer closing at unfavourable 5.2% 12 months so far.

Now that we’re a foot into a complete new 12 months, I imagine some stage of optimism is significant in direction of precise restoration.

However, segregation and compartmentalisation of milestones are crucial in direction of reaching an finish objective.

By conducting elements of the tip sport, these child steps are what lays the inspiration to do nicely as a substitute of an unrealistic blue print.

This is an efficient approach to method New Year resolutions and by the way, in direction of the inventory market as nicely.

Instead of forecasting an general index goal value, perhaps breaking down the sectors and chosen trade for the funding portfolio is a extra viable method.

Banking sector proxy to financial restoration

It goes with out saying that the banks must be the first consideration in any funding portfolio. Apart from it being most secure with good dividend yields, for the previous 5 years, the banks has been on decline in tandem with our financial efficiency.

Coming from a low base and resilient efficiency all through the pandemic, worth has emerged for a lot of listed banks. With financial restoration in sight coupled with vital provisions made, banks are closest to the heartbeat of the economic system.

Consumer shares present secure demand

Regardless of any uncertainty, client items are requirements that are required every day. Even throughout an entire lockdown as a result of pandemic, the fast paced client items (FMCG) sector remained in operations and continued to operate. While their progress prospects are nowhere as enticing as extremely disruptive know-how firms and the margins are skinny, the secure demand particularly for client items could be one other good choice for constructing a stability portfolio.

Export shares hedge in opposition to home weak spot

The trade price for the greenback to ringgit closed the 12 months at 4.18 in comparison with 4.02 in the beginning of the 12 months. In impact, the ringgit has weakened round 4.5% for the 12 months regardless of many forecast in the beginning of 2021 anticipating the ringgit to strengthen in direction of 3.8.

While many could choose to put money into export shares for the potential foreign exchange achieve as a result of extended weak spot in our forex, I firmly imagine export shares are enticing due to their constant income stream for international markets and robust cashflow. They are additionally considerably insulated from the weak spot in home economic system and native insurance policies. In addition, the potential progress prospect is there because of their goal market isn’t confined by the constraints of our border. In brief, the world is their oyster.

Risk for 2022

The price hike and concern for taper tantrum are amongst the financial coverage threat which can have an effect on fund flows globally particularly in direction of an rising market like Malaysia. While the United States Federal Reserve (Fed) price hike has been estimated to be thrice in 2022 and seems to be factored in by the market, my main concern lies with the tapering of company bond shopping for by the Fed.

In the previous many junk bonds and zombie firms had been being propped up due the beneficiant liquidity available in the market, within the occasion the faucet begins to close tight, what would occur to those firms? In phrases of price hike, our present in a single day coverage price is kind of low and there’s ample room to navigate within the occasion there’s a have to observe swimsuit.

Apart from that, domestically, there’s the ever-impending fifteenth General Election behind the thoughts of the politicians and folks. With this uncertainty in place, it’s laborious to count on a bull run for the inventory market particularly if international funds are going to take a cautious method. Unless and till the political uncertainty is taken out of the equation, it’s laborious for buyers to be undertake a threat on method in 2022. With near RM101 billion withdrawals in 2021, the Employees Provident Fund (EPF) needed to navigate the biggest internet outflow in a single 12 months all through its historical past but additionally to satisfy the dividend obligations to members to be declared in 2022. This led to a steady promoting by EPF in addition to different native establishments additional exacerbating a downtrodden native fairness market.

The upside nonetheless could be the excessive probability that EPF will now not have additional withdrawal programmes from the “sacred” Account 1. This to an extent will stymie the promoting by native funds and supply a flooring to the index ought to some stage of help by native establishments return to the market.

When Benjamin Franklin wrote the expression “little strokes fell great oaks” in Poor Richard Almanack, he meant that great duties will be completed by way of many small however persistent efforts. That is what I’d say greatest mirrored 2021 for me and what I aspire to proceed for 2022.

While issues could look bleak for our nation at instances as a result of infinite stream of points, be it the pandemic, floods, political maneuvering or weak employment market, I imagine there is no such thing as a single fast repair.

Therefore, perhaps the playbook for these in energy ought to contemplate adopting of their try to put Malaysia again heading in the right direction, could be to take little strokes as a substitute of going for one grand swing. Wishing all readers a Happy New Year and will 2022 be a beautiful 12 months forward.

Ng Zhu Hann is the writer of “Once Upon A Time In Bursa”. He is a lawyer and former chief strategist of a Fortune 500 Corp. The views expressed listed here are the author’s personal.