THERE are a number of factors that influence the movement of a currency, and foreign fund flow is one of them.

Just like how strong net exports drive up the demand for the exporting nation’s currency, and in turn cause the local legal tender to appreciate, a net inflow of foreign funds such as in the form of portfolio and direct investments would also boost the domestic currency.

In simple terms, examples of foreign direct investments (FDIs) would include a multinational corporation establishing a factory in Malaysia.

Meanwhile, foreign portfolio investments refer to the buying of bonds and equities in the capital markets.

In the case of Malaysia, net FDIs have continued to be in the positive territory for many years, although it has largely been on a downward trend after hitting a peak of RM47bil in 2016.

In 2020, the net inflow contracted by 54.8% to RM14.6bil, following the adverse implications from the Covid-19 outbreak.

As for the portfolio investments, particularly in the bond market, RAM Ratings said last month that foreign interest in Malaysian bonds has been waning.

Foreign investors turned net sellers of Malaysian bonds in June, resulting in a net foreign outflow of RM497.1mil.

This effectively ended a 13-month streak of net foreign inflows, with falling demand observed since May.

According to RAM Rating, the continued weak foreign appetite may be partly attributed to heightened risk aversion amid rising Covid-19 infections, the extension of full lockdowns, and uncertainties on the economic and political front.

“Investors may also be repositioning their portfolios towards the United States to capitalise on growing prospects of faster-than-expected interest rate normalisation.

“While still-positive yield differentials favouring Malaysian Government Securities (MGS) and Government Investment Issue (GII) should continue to support capital flows in the short term, a strong recovery in the US could drive investors away from emerging markets that are still struggling with the economic fallout of the pandemic,” it said.

Despite the waning foreign investor interest in local bonds, the situation cannot be worse than what is experienced in the equities market.

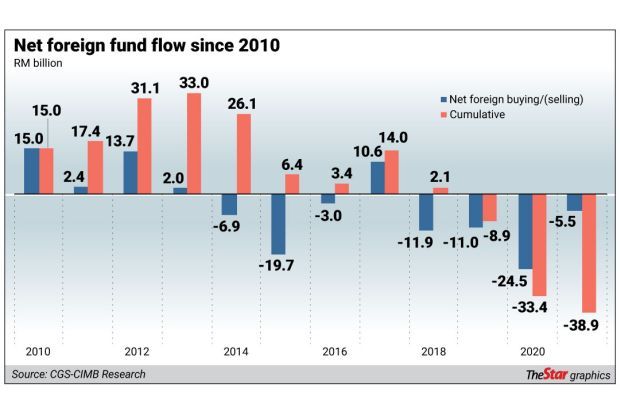

Since 2015, noticeably after the 1Malaysia Development Bhd (1MDB) crisis erupted, Bursa Malaysia has been continuously hit by foreign fund outflows.

The year 2017 was the only year in this period that saw a net inflow.

Up until July 2021, net selling of equities by foreign investors in Bursa Malaysia has stretched to 18 consecutive months.

CGS-CIMB Research said that in July 2021, net selling by foreign investors increased by 14% month-on-month (m-o-m) to RM1.3bil.

In the first seven months of this year, Malaysia recorded a total of RM5.54bil in net outflow of foreign funds.

Responding to StarBizWeek’s question on whether foreign funds are becoming less interested in Malaysian stocks, MIDF head of research Imran Yassin Md Yusof says it is difficult to provide a definite answer.

“This is because we have observed (at times) foreign funds showing interest in our market. For example, in the month of March, if it was not for the last day, we would register a net inflow position for the month.”

There are many possible answers why Malaysia may not be appealing to foreign investors. One of them is the low trading velocity in Bursa Malaysia. As regional stock markets get bigger with new and large companies listed, Bursa has to up its game to avoid the bourse from shrinking, relative to regional competitors.

For now, with continued dumping of local stocks by foreign investors, it is no surprise that the market sentiment and performance have been impacted. Between January and July 2021, the market cap of the Main Market has been erased by 4.5%.

The ACE Market is worse affected as the market capitalisation tumbled by almost 10% in the same period.

Earlier this week, CGS-CIMB Research said that the stock market’s average daily trading volumes and values for the month of July 2021 continued to fall m-o-m to its lowest levels since April 20, indicating a weak market sentiment.

“Average daily trading volumes fell by 15% to 5.1 billion units while average daily trading values fell by 10% m-o-m to RM3.1bil in July 2021,” stated the research house in a note.

Net outflow of foreign funds does not stop at weakening the stock market but also affects the ringgit performance. Alliance Bank chief economist Manokaran Mottain says that such net outflows play a significant role in suppressing the ringgit.

“Lack of confidence in the market, continuing political issues and the fact that other economies are becoming more competitive in terms of policies and economic direction would negatively affect foreign investors’ confidence in the Malaysian capital markets.

“These only create headwinds for the currency,” according to him.

Until such issues are resolved, Manokaran expects the ringgit conditions to remain weak.

“Within the next 12 months, the ringgit may continue to trade range-bound between RM4.20-RM4.30 per US dollar,” he adds.

Malaysian Rating Corp Bhd chief economist Firdaos Rosli points out that the ringgit has been on a downward trend since March 2021, despite the rise in crude oil prices.

“We believe that ringgit’s performance of late is sentiment-driven, tilting towards external rather than internal factors. The expectations of tightening US monetary policy will likely impact emerging markets’ currencies, including the ringgit.

“So long as the prospects of US Federal Reserve tapering remain, the ringgit will continue to be under pressure,” he says.

From the internal perspective, Firdaos adds that the outlook on the ringgit has weakened following the implementation of the full movement control order and looming political tensions.

Commenting on the foreign fund flows, Firdaos says foreign inflows into bonds have always been more than outflows from equities in any given year.

“Malaysia has a much more significant percentage of foreign holdings in the bond market, so naturally, the foreign flows will be much higher in bonds than in equities. Also, I think it has a lot to do with the risk profile and adequacy of risk assessment between bonds and equities,” he says.

Firdaos says foreign investors prefer Malaysian bonds compared to equities, considering that the risk sentiment in Malaysia had worsened.

“Foreign investments into local government bonds are held mainly by asset managers, central banks or governments and pension funds. Such investors usually have long-term views. Foreign investors also prefer local government bonds amid their attractive yield valuation at a higher credit rating status when compared to its regional peers except Singapore,” he says.

Echoing a similar view, MIDF’s Imran says foreign investments into Malaysian bonds remain resilient as bonds, especially MGS, have lower risk than equities.

With the bond market participants being finance professionals and sophisticated investors, he says sentiment is less of a factor and hence, less knee-jerk reaction.

Looking ahead, Imran believes Malaysia could once again record foreign funds inflow when the country reaches its vaccination target and reopens its economy. More clarity on the political situation may also lead to foreign funds inflow.

“This is due to the relatively cheap valuation of our market at the moment,” he says.