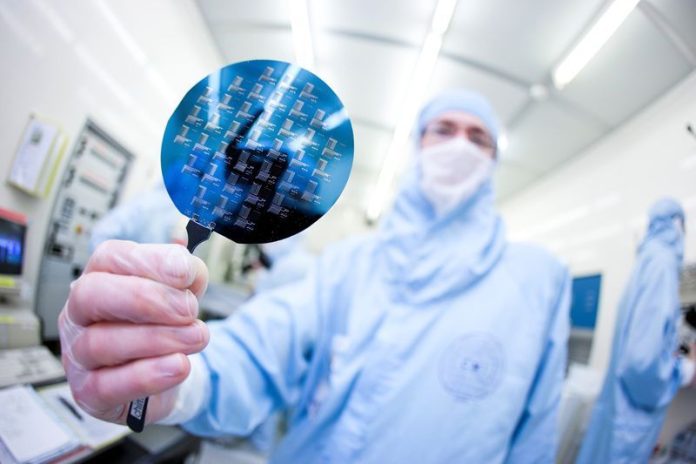

BERLIN (Reuters) -German wafer maker Siltronic noticed an excellent begin to 2022 and is satisfied it can go it alone after a deliberate sale to Taiwan’s InternationalWafers collapsed, saying international demand for scarce chips will stay excessive in the long run.

“We now see ourselves in a powerful place to stay profitable as an impartial firm,” Chief Executive Officer Christoph von Plotho mentioned on Wednesday, citing a deliberate new manufacturing unit in Singapore that displays its development ambitions.

A powerful financial rebound from the pandemic in addition to rising demand for semiconductors from the tech and automotive industries have triggered a worldwide scarcity of chips, fuelling demand for brand spanking new manufacturing capability worldwide.

Siltronic mentioned it anticipated these “megatrends” to make sure excessive demand within the mid- to long-term, an element that has additionally boosted efforts to arrange extra chip manufacturing capability in Europe to cut back dependence on Asia.

InternationalWafers’ deliberate 4.35-billion-euro ($4.89 billion) takeover of Siltronic collapsed late on Monday because the deal didn’t obtain regulatory approval in time.

The door stays open for an additional try, though InternationalWafers mentioned it would announce on Feb. 6 how it supposed to make use of the cash the deal would have value.

Siltronic shares had been final up 3.1% at 124.20 euros. InternationalWafers had bid 145 euros per share.

Von Plotho, in an interview with Frankfurter Allgemeine Zeitung, mentioned a recent bid on the identical degree could be “barely enticing” in mild of extra beneficial situations within the business since InternationalWafers first bid in late 2020.

“Much has modified. Wafers are scarce, and costs are going up,” he instructed the paper.

Siltronic reported a 17% rise in fourth-quarter earnings earlier than curiosity, taxes, depreciation and amortization (EBITDA) to 144 million euros, boosted by the discharge of round 12 million euros in provisions after the failed deal.

Full-year gross sales rose 16% to 1.405 billion euros, due to a rebound from depressed 2020 ranges, a stronger U.S. greenback and barely greater costs within the second half of the yr.

Siltronic mentioned ongoing geopolitical and international financial uncertainties, in addition to the pandemic, would proceed to form 2022 and warned rising prices and inflation would weigh on earnings.

($1 = 0.8862 euros)

(Reporting by Riham Alkousaa and Christoph SteitzEditing by Subhranshu Sahu and Mark Potter)